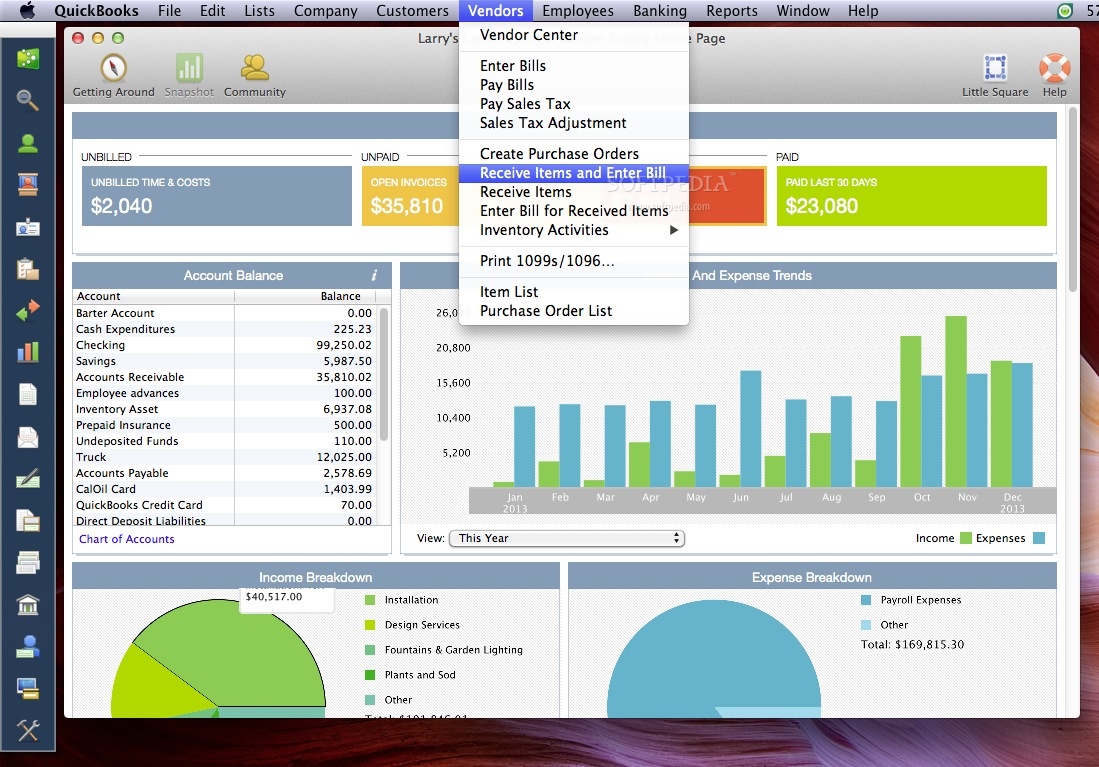

It benefits businesses by guaranteeing correct payroll processing, decreasing administrative burdens, and well timed employee payouts. QuickBooks Payroll, by Intuit, is a complete payroll solution for small companies, offering automated payroll, tax filings, and HR help. It integrates seamlessly with QuickBooks On-line for streamlined bookkeeping.

Quickbooks Time Use Instances

We appreciate that QuickBooks Payroll provides multiple subscription choices. These tiers, detailed below, allow companies to choose one of the best plan for their needs. That is faster than the two-day or next-day choices provided in lesser plans. If sales are slightly slow, you can wait till the last minute to fund the payroll.

Customers express concern over the time it takes to get assist, citing long hold instances and generally insufficient help, particularly with difficult issues like a tax correction. When it involves payroll taxes, you actually want a fast, solid reply, so be prepared to be affected person or rent a great ProAdvisor when you anticipate needing a lot of help. The QuickBooks Workforce app or portal is an worker self-service platform. It permits your team members to securely access their pay stubs, W-2 and 1099 tax forms, and update their private data on-line.

Time & Project Monitoring

- Its Elite plan will assign an skilled to get it carried out, as long as you give them the required paperwork beforehand.

- A high rating reflects specialized or unique features that make the product quicker, extra environment friendly, or provide further value to the user.

- However, some elements, such as advanced reporting options or establishing particular payroll integrations, might require a bit of a studying curve.

- QuickBooks Time is a software designed to track and handle employee work hours and locations.

- Our interactions with the QuickBooks group had been primarily optimistic, with relatively fast response instances and correct answers to our questions.

We favored that we might track sick and trip pay or let the system mechanically accrue hours per pay period. Several top-rated payroll companies permit unlimited payroll runs. With an Intuit QuickBooks Payroll account, you’ll be able to run payroll for employees, contractors or freelancers routinely or manually as typically as you want. QuickBooks calculates wages and deductions to make sure correct payroll withholding, after which enterprise owners evaluate and submit payroll for processing. File late or sort in the mistaken quantity, and the I.R.S. can slap you with a fine.

QuickBooks Payroll has a $12 month-to-month payment for each filing obligation outside of the primary state. For companies with distant staff, these multiple-state-filing charges could actually add up. For all three plan tiers, federal and state payroll taxes are calculated, filed and paid routinely.

QuickBooks Payroll supplies professional evaluation with its top-tier plan. Just Lately, it has added live support to its QuickBooks On-line intuit online payroll plans. If you don’t opt for a 30-day free trial, you probably can access one-time reside setup support within the first 30 days.

Intuit Quickbooks Payroll Pricing

If you’re already utilizing QuickBooks On-line for accounting, the two integrate seamlessly, enabling you to manage both accounting and payroll from a standard platform. QuickBooks Payroll also made it to our record of best payroll software program for small businesses. As A End Result Of it’s a cloud service, you can run payroll out of your workplace, your own home, or even a quiet espresso store using the cellular app. This freedom is large, especially for business owners who’re continually on the move or manage distant teams. When you started your small business, you in all probability didn’t dream of spending Friday afternoon manually calculating withholding taxes and filling out authorities varieties. That’s the place the ability of a true cloud-based payroll system comes in.

You’ll need to have your company’s core authorized documents useful. As Quickly As the employer-side setup is complete, you probably can invite your staff to the QuickBooks Workforce portal. Choosing the right plan actually is decided by the size of your group, how a lot stuff you want the system to handle for you, and your finances.

Whether you add a payroll module to your present QuickBooks account or purchase a bundled plan, paying workers is a breeze. Furthermore, small companies benefit from federal and state tax filing by way of QuickBooks, in addition to tax penalty safety. QuickBooks Payroll is a great selection should you already use QuickBooks Online and are looking for payroll software program that may make your life just a bit simpler. Though it’s designed for companies with as much as 50 workers or contractors, it might possibly accommodate up to 150 employees. The software integrates immediately with QuickBooks Online, can run payroll automatically and presents same-day or next-day direct deposits. Three plan choices imply businesses can upgrade as they develop and require more providers.

Intuit has created an ecosystem of its personal when it comes to apps for small companies. QuickBooks Payroll calculates, information and pays all federal and state payroll. All the relevant tax forms for regular employees in addition to https://www.quickbooks-payroll.org/ contractors are generated automatically.